Financial data organization and consolidation are essential in the contemporary, high-speed corporate setting. If you require assistance with planning, forecasting, and reducing costs, SAP Business Planning and Consolidation (SAP BPC) is the ideal solution. This post will examine SAP Business Planning and Consolidation, its characteristics, and its ability to aid enterprises in achieving their financial objectives.

Table of Contents

Introduction of SAP BPC

Before we delve into how to plan and consolidate with SAP Business Planning and Consolidation (SAP BPC), let’s first define what planning and consolidation are at the most basic levels of business activities and explain their associated approaches. Studies show that most failures stem from inadequate planning or design. When CEOs of these failed corporations were asked why they failed, their primary regret was usually related to not planning enough or failing proactively.

Planning, budgeting, and forecasting can be a complex process that can be difficult to do accurately, timely, and consistently. Many people fail to plan correctly due to the complexity of the process. Identifying accurate processes, such as the true cost of doing business and the cost of generating sales, is crucial for successful execution. Consolidation is necessary for corporations operating across multiple countries or currencies with shared activities, as it helps maintain efficiency across the organization. Addressing these questions can help ensure the successful execution of corporate processes.

What is SAP Business Planning and Consolidation?

What is BPC SAP?

SAP BPC is a crucial tool in financial planning, budgeting, forecasting, and consolidation within organizations. It streamlines complex financial processes by providing a unified platform for efficient data collection, analysis, and reporting across business units. It empowers decision-makers with real-time insights into financial performance, enabling informed choices and resource allocation. SAP BPC ensures accurate financial consolidation across subsidiaries, adhering to regulatory requirements, reducing manual effort and errors.

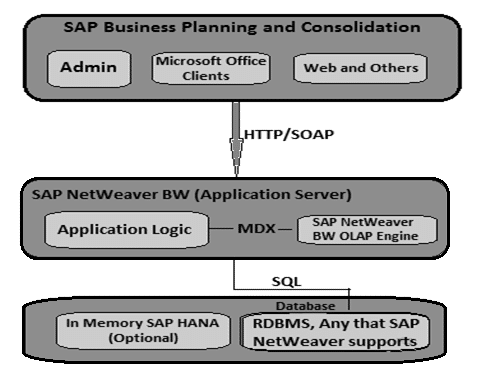

SAP Business Planning and Consolidation Overview

SAP Business Planning and Consolidation (BPC) is a tool that streamlines business forecasting, planning, and consolidation activities within an organization. It supports SAP NetWeaver and Microsoft Excel migrations, allowing users to perform modeling, application maintenance, data imports, and script creation. BPC leverages the power of MS Excel, providing an Enterprise Power Management (EPM) solution and a robust, user-friendly environment. It supports existing Microsoft functionality and offers enhancement features like drag and drop report builder.

Following are the key benefits provided by SAP BPC

- It allows the user to make better business decisions by supporting What-If analysis and allows you to perform scenario-based planning.

- It allows you to collaborate data and thus increase accuracy in business planning and accountability.

- It helps in aligning your plans with strategic goals and hence decrease the cycle time.

- You have an option to choose the version of SAP NetWeaver or Microsoft Platform.

Following are the key benefits that can be achieved by using BPC

- Business Forecasting

- Analytical Reporting and Analysis

- Budget Planning

- Predictive Analysis and Recommendations

- Improve Compliance

- Consolidation

- Business Process Flows and Smooth Collaboration

What is EPM?

SAP Enterprise Performance Management (EPM) allows your organization to improve its financial and operational performance management. SAP EPM supports various functionalities with SAP Business Planning and Consolidation – BPC-NW or BPC-MS, like financial consolidation, financial information management, supply chain performance management, strategy management and many more areas.

SAP Business Planning and Consolidation can be installed locally or in the cloud, allowing companies to customize it according to their needs.

Types of SAP BPC

The Standard Model is a SAP option within the host Business Warehouse’s protected namespace “/CPMB/”. It separates BPC transaction data and master data, ensuring the sub-processes associated with this model are secure and managed by the app’s running department. This model allows customers to plan and consolidate within their own department without sharing resources with other Business Warehouse community users. The code set of the Standard Model is coordinated with version BPC 10.0, allowing code compatibility between BPC 10.0 and BPC 10.1, facilitating easy migrations and upgrades. In the Standard Model, the BPC environment contains BPC applications or models, with each model generating a hidden BW InfoCube.

The Embedded Model is a different approach to SAP BW Integrated Planning and Planning Application Kit, offering data access to all community users. It differs from the Standard model, which uses SAP BW-IP and PAK. This model allows easy access to transactional and master data within the host BW, shared with multiple users and controlled by the administrator group. Migration from older versions of Business Warehouse IP and BW-IP is relatively easy, while earlier versions like BPC 10.0 and earlier are considered new implementations. In this model, any number of InfoProviders can be assigned to a single BPC model/application.

The SAP BPC is optimized for SAP S/4HANA, a next-generation ERP suite. It utilizes its in-memory database and computing power for faster data processing, efficient handling of large data volumes, and seamless integration with other modules.

SAP BPC – Reporting

SAP BPC 10.0 allows you to get data from source systems in to an Excel interface. It allows you to analyze the multidimensional data and BPC 10.0 provides number of inbuilt templates that can be used for analyzing and you can also add different formulas to design reports. SAP BPC 10.0 provides various exceptional capabilities including integration with SAP HANA over BPC 7.x to handle big data environment for reporting purpose. SAP BPC also provides use of input schedules that allow you to send the data from report to database. Input schedules provide you with all the functionalities as that are available in BPC reports. The difference between Report and Input Schedules is that

reports are used for analyzing data and input schedules are used to write data to database.

You can opt from the following methods to create reports and input schedules in Business Planning and consolidation tool.

- Using Default Templates

- EvDRE Builder

- Drag and Drop Interface

- Blank Workbook

What is the distinction between BPC and BW?

SAP BPC (Business Planning and Consolidation) and SAP BW (Business Warehouse) are two distinct solutions from SAP that serve distinct functions.

SAP BPC (Business Planning and Consolidation) and SAP BW (Business Warehouse) are distinct systems with different purposes. BPC is a unified planning and consolidation tool that streamlines financial planning, budgeting, forecasting, and reporting. It ensures compliance with regulations and facilitates faster, more accurate closings. It can integrate with other SAP solutions for seamless financial management. Conversely, BW is a data warehousing ETL tool that collects, transforms, and consolidates data from various sources. It provides a single view of data for reporting and analytics. Both systems can be integrated with other SAP modules and external systems.

Is SAP BPC Part of S/4HANA?

SAP BPC is a part of the SAP S/4HANA business suite, offering real-time access to master and transactional data, flexible drill-down capabilities, and end-to-end simulation features. It eliminates data replication and integrates planning screens into SAP S/4HANA workflows, making it a powerful solution for financial planning and consolidation within the SAP ecosystem.

Who uses SAP BPC?

Organizations of all sizes across industries frequently use SAP BPC (Business Planning and Consolidation) to manage their financial planning and consolidation processes. Here are three types of organizations that utilize SAP BPC:

Large Enterprises

Large enterprises widely use SAP BPC to manage their complex financial planning and consolidation processes, such as budgeting, forecasting, and financial reporting.

MNC Organization

SAP BPC is ideal for multinational corporations that must consolidate financial data from multiple entities and comply with various financial reporting standards.

Financial services Firms

SAP BPC is used by financial services firms such as banks and insurance companies, to efficiently manage their financial planning and consolidation processes and meet regulatory requirements.

What is the Difference between BPS and BPC in SAP?

SAP has two distinct planning tools: BPS (Business Planning and Simulation) and BPC (Business Planning and Consolidation). Each has distinct functions. Lets us understand the difference

BPS is an established SAP planning tool that offers companies a powerful and versatile planning platform. From cost centers to the entire enterprise, BPS supports planning, budgeting, forecasting, and simulation at various levels of detail. Companies can create templates, input forms, and reports tailored specifically for their needs with customizable features like data validation, forecasting, variance analysis and scenario simulation.BPS provides an effective planning platform

BPC is an advanced SAP planning solution that offers an integrated planning and consolidation solution. BPC’s web-based interface enables users to create, manage and distribute planning information across an organization. Features like consolidation, budgeting, forecasting, and reporting can be done on one platform with BPC. BPC creates a unified planning and budgeting process that enables companies to consolidate financial data across different systems, legal entities, and currencies.BPC offers an integrated planning and consolidation solution that can effectively integrate financial data across different systems, legal entities, and currencies.

What is SAP IBP vs BPC?

SAP IBP provides comprehensive planning functionality with advanced analytics and real-time data, while SAP BPC offers a unified planning and consolidation platform that compiles financial information across different systems, legal entities, and currencies. SAP offers two distinct planning tools – SAP IBP (Integrated Business Planning) and BPC (Business Planning and Consolidation), each with distinct features.

SAP IBP is a cloud-based, real-time planning and forecasting solution that offers end-to-end planning functionality – from demand planning to sales/operations planning, inventory optimization to supply planning. IBP helps companies make faster decisions with real-time data and advanced analytics. Features of SAP IBP include scenario planning, predictive analytics, machine learning capabilities and integration with other SAP applications like SAP APO or ERP.

On the other hand, SAP BPC is an on-premise or cloud-based planning and consolidation tool that enables companies to manage their financial planning and consolidation processes in one unified platform. BPC features include consolidation, budgeting, forecasting, and reporting all in one place. Furthermore, this unified process allows companies to consolidate financial data across different systems, legal entities, currencies, etc..

SAP BPC Roadmap

The SAP Business Planning and Consolidation roadmap outlines the future direction of their solution. SAP BPC roadmap indicates a commitment to continuous innovation and improvement of the solution, with the aim of offering an accessible yet comprehensive financial planning and consolidation platform. Here are some key highlights from it:

Cloud-First Approach

SAP BPC will continue focusing on its cloud offering, emphasizing cloud-first development and deployment.

SAP BPC User Experience Improvements

SAP is dedicated to continuously improving the user experience with its business process controller (BPC), including modernizing the interface and streamlining navigation and user workflows.

Integrated Planning and Analytics

SAP BPC will remain tightly integrated with other SAP solutions, such as SAP Analytics Cloud, to offer a unified planning, reporting, and analysis platform. SAP BPC will continue to enhance its financial consolidation capabilities, aiming to streamline the process and minimize errors.

Advanced Predictive Analytics

SAP BPC will continue leveraging advanced predictive analytics capabilities to provide precise financial forecasts and enhance decision-making.

Support of New Accounting Standards

SAP BPC will continue to adhere to emerging accounting standards such as International Financial Reporting Standard (IFRS 16), which necessitates capitalizing operating leases.

SAP BPC Performance and Scalability Enhancements

SAP is committed to optimizing the performance and scalability of SAP BPC, with the goal of decreasing time spent completing financial planning and consolidation tasks.

How SAP BPC Works

SAP BPC is a software that streamlines financial planning and consolidation for businesses. It provides a structured framework for storing and sharing financial data, improving accuracy and eliminating inconsistencies. SAP BPC also offers real-time reporting, enabling businesses to analyze financial records and make informed decisions based on facts. This tool enhances operational efficiency, reduces costs, and improves decision-making based on accurate financial data.

Conclusion

SAP BPC, a key component of SAP’s BPC, is a comprehensive software solution that enhances operational efficiency, reduces expenses, and provides accurate financial data for businesses.

You might also like the below articles.

- SAP Business One

- Production Planning

- Software Testing: Tips and Tricks to Ensure Quality and Efficiency

- SAP PM Module

- SAP Data Archiving

- Greenfield vs brownfield

- SAP Central Finance

- SAP Enable now

- SAP Automation tools

- SAP Customer Relationship Management

- Debugging for functional consultants

- SAP BRIM

- SAP ALM

- Cloud computing

- SAP Technical

- SAP Solution manager

- SAP C4HANA

- SAP Successfactors

- MRP live

- Inventory management

- SAP Best Practices